At an event hosted by the Bay East Association of REALTORS® on November 5, 2025, veteran real estate professional Bob Baptiste captivated attendees with his presentation, “Building Generational Wealth Through Real Estate.” Drawing from decades of experience in Bay Area real estate, Baptiste provided both practical insights and a long-term vision for how individuals and families can leverage property ownership to achieve stability, independence, and enduring wealth.

But his presentation went beyond investment strategy. It was, at its core, about empowerment — particularly for those who have historically been excluded from wealth-building opportunities in the housing market. In the context of a region like Alameda County, where affordability challenges, displacement pressures, and generational inequities continue to shape the housing landscape, Baptiste’s message resonates deeply: real estate remains one of the most powerful and accessible tools for economic mobility — if approached with knowledge, discipline, and a sense of responsibility.

The Three R’s of Real Estate Success

Baptiste’s framework for sustainable success in real estate is built around what he calls the “Three R’s” — Resale, Rentals, and Renovation. Each of these pillars, he explained, represents not only a distinct business model but also a different pathway toward building long-term wealth.

1. Resale: Turning Market Knowledge into Opportunity

The resale segment of Baptiste’s model focuses on the fundamentals of buying and selling properties. Success in this area, he emphasized, depends on lead generation, area farming, open houses, and the cultivation of a strong professional network — what he described as one’s sphere of influence.

By understanding market cycles and maintaining authentic relationships within the community, real estate professionals can identify opportunities that others might overlook. But for Baptiste, resale is not simply about turning a profit. It’s about building trust and establishing a reputation for integrity and reliability.

“Real estate isn’t just about transactions,” he noted. “It’s about people — helping them make informed decisions that shape their financial future.”

This people-first approach is especially relevant in the Bay Area’s competitive housing environment, where informed agents and ethical practices are crucial to bridging gaps between buyers, sellers, and communities.

2. Rentals: The Cornerstone of Generational Wealth

The rental market, Baptiste argued, is the foundation of financial independence and intergenerational security. Unlike resale, which provides one-time profits, rental ownership generates ongoing cash flow, tax benefits, and long-term asset appreciation.

Baptiste encouraged investors to think strategically about their portfolios — balancing single-family and multi-family units, assessing debt service and cash-out opportunities, and adhering to practical metrics such as the 1% rule (monthly rent should equal at least 1% of the property’s purchase price).

But his advice extended beyond financial mechanics. Baptiste urged investors to prioritize asset improvement and property quality. Well-maintained properties not only retain value but also create stable housing for tenants — a vital consideration in a region struggling with displacement and affordability.

He also highlighted the value of participating in subsidized housing programs, including Section 8, calling them “great investments — good for families and for the community.” In doing so, he challenged misconceptions about these programs, framing them instead as opportunities to ensure consistent income while fulfilling an essential social need.

To maximize long-term growth, Baptiste recommended periodic exchanges every two to three years, allowing investors to “trade up” — selling smaller properties and reinvesting in larger or more diversified portfolios. This strategy, he explained, enables incremental wealth accumulation while deferring capital gains taxes under the 1031 exchange provision.

3. Renovation: Adding Value and Revitalizing Communities

The third “R,” Renovation, reflects Baptiste’s belief that real estate investment can — and should — contribute to community revitalization. The process of transforming neglected or undervalued properties, he explained, can yield both financial return and social impact.

He described a methodical approach to renovation: identifying assets through foreclosure lists, probate sales, and real estate networks; setting clear profit margins of at least 5–10%; and managing projects with discipline and accountability.

While renovation can be high-risk, Baptiste underscored its potential to build equity quickly and provide buyers and renters with high-quality housing options. In regions like Alameda County, where much of the housing stock is aging, thoughtful renovation can breathe new life into neighborhoods — strengthening the housing ecosystem overall.

From Earning to Preserving: Managing Wealth Across Generations

Baptiste closed his presentation by emphasizing a theme that often gets lost in conversations about wealth building — the importance of preservation. Earning money, he said, is only the first step. The true challenge lies in managing, protecting, and growing that wealth for future generations.

To that end, he encouraged attendees to focus on financial discipline, including managing personal expenses, understanding tax obligations, and investing in retirement accounts such as SEPs, IRAs, and pensions.

He also recommended diversifying beyond real estate, balancing portfolios with stocks, mutual funds, ETFs, bonds, and even precious metals. This approach not only mitigates risk but ensures that one’s wealth remains resilient through economic fluctuations.

“Real wealth,” Baptiste explained, “isn’t just what you earn — it’s what you keep, protect, and pass on.”

A Broader Vision: Housing as a Community Ecosystem

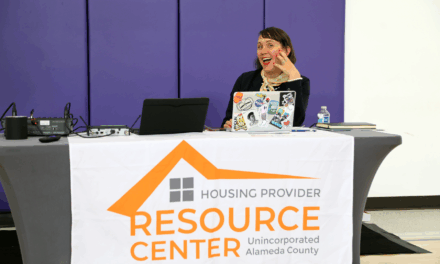

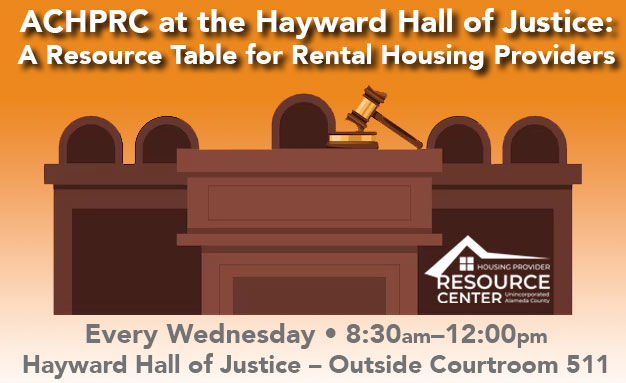

Baptiste’s framework dovetails with the mission of the Alameda County Housing Provider Resource Center (ACHPRC), which aims to foster collaboration between property owners, renters, and community partners to ensure a balanced and equitable housing ecosystem.

In Alameda County, small rental property owners play a crucial role in maintaining housing stability. Yet they often face financial pressures from rising costs, deferred maintenance, and evolving regulations. Baptiste’s model — rooted in education, reinvestment, and ethical property management — offers a pathway for these owners to thrive while contributing positively to the housing landscape.

As the Bay Area continues to grapple with housing inequities and the widening wealth gap, the principles of responsible ownership and community reinvestment become ever more essential. Baptiste’s call to action is clear: by approaching real estate not just as an individual pursuit but as a generational and communal responsibility, we can build a more stable, inclusive, and prosperous future.

Moving Forward

The ACHPRC remains committed to supporting small rental property owners through education, advocacy, and access to resources that strengthen both individual financial health and community well-being.