Alameda County Tax Assessor Phong La has issued an important reminder to all property owners: the first installment of the 2025–26 Secured Property Tax bill is due on Wednesday, December 10, 2025. Payments must be received or USPS-postmarked by 5:00 p.m. on that date to avoid penalties.

Once the deadline passes, a 10% delinquency penalty will be added to any unpaid balance. The Assessor emphasizes that there are no grace periods and penalties cannot be waived, so early action is strongly encouraged.

How to Check Your Tax Bill and Make Payments

Property owners can review their tax bill, verify payment status, pay electronically, or find answers to frequently asked questions on the Alameda County Tax Collector’s webpage or by calling (510) 272-6800. The information available online is the same information provided by customer service agents.

Mail Early—Postmark Rules Strictly Enforced

Because penalties are based on the USPS postmark date, owners should mail payments early to ensure timely processing. The County only honors United States Postal Service (USPS) postmarks as proof of on-time mailing.

Late postmarks—even if mailed before the deadline—will result in penalties.

Important: The mailing address for payments has changed.

Alameda County now uses a lockbox service for faster processing. Payments should be mailed to:

PO Box 45862

San Francisco, CA 94145-0862

Payments can still be submitted in person at:

1221 Oak Street, Room 131

Oakland, CA 94612

Available Payment Options

Property owners may choose from several safe and convenient non-contact payment methods:

1. Pay by Mail

- Mail a check or money order using the provided envelope.

- Ensure the payment is USPS-postmarked by December 10, 2025.

- Do not send cash.

2. Pay Online

- Use the County’s online payment portal to pay by:

- eCheck (free)

- Credit card (transaction fee applies)

- eCheck (free)

- eCheck users should verify bank processing within three business days.

3. Pay by Phone

- Call (510) 272-6800, select Option 1, and follow the prompts to pay by credit card.

- Available 24/7 through an automated system.

- Agents cannot process payments over the phone.

4. Bank Bill-Pay

- Payments must be scheduled well before the deadline to allow your bank time to mail the check.

- Use your parcel number or tracer number to identify your property.

5. Wire Transfer

- Payments may be wired electronically; instructions are available online.

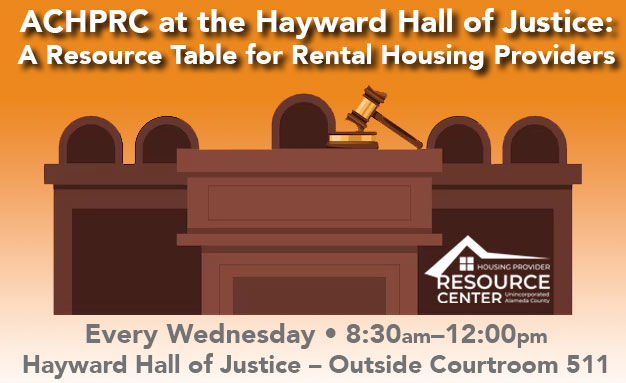

6. In-Person Drop Boxes

Two secure drop-off locations are available Monday–Friday, 8:30 a.m.–5:00 p.m. (excluding County holidays):

- 1221 Oak St., Oakland – Drop box at the building entrance

- 224 W. Winton Ave., Hayward – Mail slot at the Business License Office

Do not deposit cash in drop boxes or mail slots.

International Payments

Due to security protocols, online payments may not be accessible from outside the United States. Property owners abroad should use one of these alternatives:

- Automated phone payment using a credit card

- Mail (USPS postmark rules still apply)

- Wire transfer

International mail must arrive with a USPS postmark to be considered on time—foreign postmarks are not accepted.

Payment Confirmation and Records

Your canceled check serves as your receipt.

Once payments are processed, property owners may print their updated tax statements through the County’s online system.