A new report from the Terner Center for Housing Innovation at UC Berkeley is shedding light on a sector of the housing market that provides millions of homes nationwide but receives little attention: small multifamily rental properties. Defined as buildings with five to 49 units, these properties make up an estimated 17 percent of the country’s rental stock, yet the people who own and manage them often face outsized challenges in today’s housing economy.

The study, released in January 2024, surveyed hundreds of owners and managers across the United States. Its findings highlight a stark reality: many of the rental property owners behind these buildings are not large corporations, but individuals and families—sometimes retirees or working-class households—who depend heavily on rental income for financial stability.

Who Owns Small Multifamily Housing

The report found that roughly one-third of small multifamily properties are owned directly by individuals, while another 38 percent are held in LLCs with individual majority owners. Only a small fraction is controlled by institutional investors.

That ownership structure matters, researchers argue, because it means policy changes, rent disruptions, and maintenance costs hit closer to home. “These are not faceless corporations,” the report notes. “They are people making decisions about property upkeep and tenant stability while managing their own financial risks.”

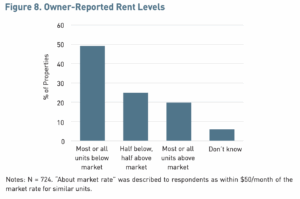

Balancing Rents and Retention

One of the more surprising findings is that nearly half of small multifamily rental property owners rent at or below market rate. The decision is often less about maximizing profit and more about keeping reliable renters. Many owners explained that the risks and costs of turnover outweighed the benefit of raising rents aggressively.

This practice, however, is increasingly strained by rising insurance premiums, property taxes, and the cost of deferred maintenance. The report warns that without better financial support, many owners may be forced to sell.

The Pandemic’s Lasting Impact

COVID-19 magnified vulnerabilities in the small rental market. Many surveyed owners reported serious cash-flow issues as tenants fell behind on rent. Some postponed repairs or capital upgrades, while others negotiated informal payment plans. Owners often shouldered these losses personally, without the buffers that larger firms could rely on.

“The pandemic revealed just how fragile this segment of the market is,” the authors wrote, warning that future economic shocks could have similar consequences unless targeted policies are put in place.

Risks of Corporate Consolidation

A central concern raised by the Terner Center is the growing wave of corporate acquisitions. As small rental property owners sell under financial or regulatory pressure, larger firms often step in. That shift can mean higher rents, stricter policies, and less flexibility for tenants, particularly when legacy owners—who frequently charged below-market rents thanks to paid-off mortgages—are replaced.

Housing advocates worry this trend will accelerate gentrification and erode what little naturally occurring affordable housing remains.

A Call for Policy Attention

The study concludes with recommendations for policymakers: expand access to financing for repairs and energy upgrades, provide education and technical assistance for small owners, and ensure rental assistance programs reach rental property owners as well as renters.

The underlying message is clear: preserving small rental property ownership is critical to housing affordability and stability. These owners are not simply business operators—they are community members whose choices affect the daily lives of millions of renters.

As Bay Area housing debates continue, the Terner Center’s report underscores a point often overlooked in public discourse: the fate of small property owners is tied directly to the future of housing affordability.

You can see the full report here.